Hope Springs Eternal for Entrepreneurship

“Smart companies are prepared for lean years”

Despite all the human and social suffering, the economic malaise – strictly speaking no recession for the time being – has the merit of daring us to question a number of “too big to fail” certainties. It has convinced us that companies, and by extension our country, must defend themselves more than ever against increasingly unpredictable shocks from outside. Where do you start?

We put this question to:

- Pieter Timmermans, CEO VBO FEB (www.vbo.be)

- Peter Van Laer, CEO BDO Belgium (www.bdo.be)

- Nadia Jansen, CEO Group Jansen (www.groupjansen.com)

Since 2008, we have been in a kind of ‘permacrisis’ or an extended period of instability and insecurity. But today, all indicators are lighting up bright red! Is the recession in sight?

Pieter: “We must distinguish between the macro- and micro-economic narrative. At the macro level, entrepreneurial Belgium faces three shocks: the explosion of gas and electricity prices will cost Belgian companies around EUR 25 billion in additional costs. Wage cost increases (between mid-2021 and mid-2023) add an additional EUR 25 to 30 billion. Thirdly, persistent inflation is fuelling the wage-price spiral, further derailing the cost of wages for companies. Of course, there are micro-economic companies that are more resilient to shocks and even do well.”

Peter: “The spectrum has two sides, with losers on the one hand and winners on the other. Energy- or labour-intensive companies are being hit hard. In addition, however, other factors play a role, such as the supply of raw materials or components, which you find difficult to control even as a high-performance company. Your stock management may be top, but if that one much-needed chip is not delivered, the entire production and sales process will stall. And that makes companies without broad financial reserves particularly vulnerable. Arming yourself against such disruptions demands creativity of a different kind.”

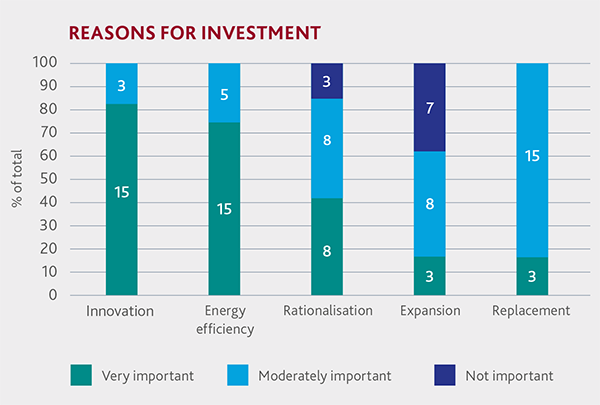

Pieter: “The fact is that due to the sharp decrease in profitability and competitiveness, companies are inclined to reduce their planned investments and build up cash flow buffers, except for investments in renewable energy sources or energy efficiency and innovation (see figure). That doesn’t have to be a big problem as long as that delay is short-lived. According to our analysis (read the box titled ‘How do the sectors see the future?’), this downward trend in investment will gain further momentum in the coming months, which will inevitably lead to a macroeconomic slowdown.”

Group Jansen also postponed investments in a new production hall due to the exploding construction costs?

Nadia: “Absolutely. Last summer we put an investment on hold at a time when there was no certainty whatsoever about budget or planning. And there were more who did likewise. In the meantime, we notice that this trend has reversed and that, as with us, investment decisions are once again on the agenda. That positive news could be reported more because as entrepreneurs we really should not be doom-mongers! Giving confidence to our employees and to the market is important and works positively, also for the morale and stress levels. Yet the narrative also has positive aspects. Investing in people, involvement, creativity, etc. is also investing. It gives hope and it supports the search for alternative solutions, it nourishes your innovative ability to do things differently and more efficiently. In times of scarcity, people become more inventive, more creative and are given a wake-up call. I continue to think positively without being naive.”

Pieter: “Never waste a good crisis. And if that has to go hand in hand with creative destruction, then we as an economy may come out of the crisis stronger. We must use the malaise to reform and prepare for the future. Nevertheless, we are currently significantly losing competitiveness compared with our neighbouring countries. Moreover, the government may well pay a large part of the crisis bill, but this cost is ultimately recovered from every Belgian. ‘There is no such thing as public money. There is only taxpayers’ money,’ said the late Margaret Thatcher in 1983. Simply passing the bill on to the next generation is not done! We urgently need bold reforms to get our competitiveness back on track. If not, we are currently sacrificing long-term prosperity in the name of maintaining short-term purchasing power.”

Peter: “Imagine if this competitiveness crisis had occurred before the coronavirus pandemic. Would we have reacted just as creatively? Thanks to the health crisis – preferably not a second time, of course – many companies made a quantum leap in terms of resilience and innovation. In other words, forewarned is forearmed. Which in no way means that we are strong enough. In a race, it doesn’t matter how fast you run yourself, but how fast your opponents are.”

“We are currently sacrificing long-term prosperity in the name of maintaining short-term purchasing power.”

Are we not winning enough?

Peter: “We win, of course, but we also miss opportunities from time to time. Our country excels in spearhead technology, but at times puts the proverbial cash cow in foreign hands. The U.S. Inflation Reduction Act – which gives billions in subsidies to companies producing in the U.S. or with U.S. components – encourages companies to invest in the States rather than here, which is to the detriment of our own future-oriented and sustainable industrial growth. After all, once you’ve invested abroad, you won’t soon return. Thankfully, the European Commission introduced the Net Zero Industry Act and the Critical Raw Materials Act as a response to this.”

Pieter: “Belgium hardly has any tangible wealth that it can draw from under the ground, the sea or the air. Our real value hovers on average 1.7 metres above ground level: talent, knowledge and creativity. Qualities that we use to participate in R&D and with which we are at the top internationally. At the same time, we have world-class tax instruments to maintain our innovation capacity. So I do not understand why the government is questioning this tax-friendly R&D policy. In this way we not only risk a brain drain, but also that domestic and foreign companies delocalise their Belgian R&D centres. This undermines the innovative power of existing and future economic clusters and ecosystems.”

Nadia: “It shows little creativity from the government. And often also a contradictory policy. On the one hand, they preach entrepreneurship while simultaneously voting for rules and regulations that drive companies away. Those kinds of fallacies or system errors should be got rid of. A struggling company will give the tree a good shake and prune a little to eventually thrive again. Our policy just allows the crown to spread and become unwieldy.”

It’s like driving with the handbrake on. Is the automatic wage indexation such a brake?

Pieter: “Between mid-2021 and mid-2023, the automatic wage indexation alone will increase the wage costs for all Belgian companies by approximately 18%. However, the system continues to present a dilemma for everyone: does the benefit of protecting purchasing power outweigh the unilateral reduction in costs on companies?”

Peter: “Every percentage point is a lot of money that you don’t earn back in a year. This means fewer resources, fewer investments, less innovation, less growth, etc. With the perverse side effect that today’s wage increase can be the spark for tomorrow’s dismissal. Looking to the future, and certainly in the case of high inflation figures such as today, it still seems appropriate to think about a system that seeks a good balance between the purchasing power of employees and the competitiveness of companies.”

“Today's wage increase can be the spark for tomorrow's dismissal.”

Pressure on the competitiveness of companies is still increasing due to the mismatch between supply and demand in the labour market… In this way, even the growth prospects of companies that are less affected by the energy and wage crisis are threatened?

Nadia: “Thanks to the continuing tightness in the labour market – the outflow still exceeds the inflow certainly until 2030 – there are no more compulsory redundancies. The number of vacancies is shrinking, but the shortage of talent remains. The wage costs explosion has only exacerbated the problem. At Jansen, we try to compensate for the loss of profitability by, for example, digitising even more, working more efficiently, delocalising or applying the principle of ‘costs that you do not incur, you do not need to finance’.”

Peter: “Other companies are pushing highly skilled labour abroad. This is an irreversible trend. We know quite well what the global labour market will look like in 2030, where there will be deficits, and where there will be surpluses. Belgium is not on the right side of the table.”

Nadia: “As the inflow shrinks, the burden on labour increases. Entrepreneurs must be creative to be and remain attractive. For example, by offering flexibility, creative remuneration, training, etc. by being close to our people. Having attention to their wellbeing. Today, the average length of service of an employee younger than thirty is one year! Today we recruit job hoppers, but we give them the opportunity to hop within our group. And above all, we match our DNA with the values of the coming generations.”

Do employees have little to worry about?

Nadia: “The market remains tight, but of course if it becomes more difficult, the least performing employees will be the first to be questioned. Stimulated by this uncertainty, there will probably be an attitude switch which will hopefully have a positive effect on the zest for work.”

Peter: “At BDO, the number of boomerang workers is growing. Apparently, the grass was not greener on the other side.”

“A company that is interesting to sell is certainly as interesting to keep.”

The great merit of the simultaneous crises that reinforce each other – the WEF calls it a polycrisis – is that we are now more convinced than ever that we must arm ourselves better. But where do you start…

Nadia: “The first reflex is to reorganise, but to do so you need time and money. And that is lacking in times of crisis. I can only speak for myself, but when I bought my father’s five companies in 2008, the financial crisis forced me to radically change course with the construction group. That was a school of hard knocks. Since then, I’ve always been wary. For example, by consciously spreading risks in markets and activities, focusing on niches, creating added value, vertically integrating and… by preparing the company for sale. Because a company that is interesting to sell is certainly just as interesting to keep.”

Peter: “Spreading, making it more robust, building in redundancy, etc. These are all proven recipes that safeguard (or at least help to safeguard) the long-term growth potential.”

When will there be light at the end of the tunnel?

Pieter: “The current cost tsunami inevitably leads to a slowdown in growth that may be greater than what most forecasting institutes expect today. The VBO/FEB fears a recession that will reach its lowest point only around the middle of 2023. Only by the end of 2023 can a cautious economic recovery emerge, provided that energy supplies stabilise at affordable prices and geopolitical cooling occurs. On an annual average, the Belgian economy would shrink by -0.5 to -1% by 2023.”

Peter: “Let’s hope that the National Bank and the Federal Planning Bureau get it right. Hope springs eternal for entrepreneurship. As Nadia said, we must remain optimistic. Do not dramatise, but do not be naive either.”

Pieter: “Our experts’ predictions are based on surveys carried out by companies and have always been more accurate than those of official bodies in recent years. At the moment, unfortunately, nothing is being done. Sooner or later, the government will have to intervene anyway, and the longer it waits, the more painful and antisocial it becomes. In the past, companies have always shown resilience. I have the utmost confidence that they will do so again. But resilience also has limits…”

How do the sectors see the future?

Twice a year, the Federation of Belgian Enterprises (VBO/FEB) surveys its sector federations to measure the economic temperature. Based on this survey (November 2022), it takes stock of the Belgian economic situation and the prospects for the coming six months. What are the findings?

For these reasons alone, according to Pieter Timmermans, there is “a need for a decisive competitiveness pact, monitoring the Belgian competitive handicap and a structural reduction in employer contributions”.

Download the VBO/FEB analysis “Focus Conjunctuur. Cost tsunami makes landfall. Competitiveness going under”.