Ins and outs of the CSRD

ESG reporting to soon become mandatory for all companies

Mieke Loncke, Marketing & Communication Director BDO Belgium

The results of our recent poll speak for themselves: the majority of companies (+70%) consider the European Corporate Sustainability Reporting Directive (CSRD) to be a driver for change. The impact, risks and opportunities of this mandatory transparency reporting directive should not be underestimated. Even though unlisted SMEs are not required to submit a sustainability report before 2027, the trickle-down effect – the pressure from investors, banks, governments, suppliers, customers and other stakeholders – will compel them to do so anyway. Precisely because the CSRD will be such a game changer for businesses, we believe that it is important to proactively inform our clients and the market about the “why”, “for whom”, “when” and “what” of the new directive.

In June 2022, the Council and the European Parliament reached a (provisional) political agreement on the Corporate Sustainability Reporting Directive (CSRD), which seeks to increase transparency in the context of the European Green Deal. The new directive amends the current Non-Financial Reporting Directive (NFRD), which applies to some 12,000 companies that operate in the EU. The new CSRD, however, applies to a much larger number of companies – around 49,000 according to a rough estimate – across all industries. In-scope companies will also have to prepare management reports following a uniform reporting standard. A (limited) assurance requirement will also apply. This means ensuring accurate, complete and consistent reporting.

“Transparency about ESG performance provides investors, banks, governments, customers and other stakeholders with accurate information that informs their decisions to invest in or cooperate with companies. In a sense, this ESG information is like the missing link in the bigger picture.”

Why sustainability reporting?

While the CSRD may just seem like a reporting obligation, the directive is designed to provide the fundamentals for companies to become more sustainable and increase long-term resilience. Therefore, careful definition of your ESG objectives (environmental, social and governance) and reporting on their performance will thus become an essential complement to your financial performance. The CSRD provides a framework for the harmonisation of non-financial reporting, ensuring information is relevant, comparable, reliable, easy to access and usable. “Transparent reporting provides companies with a framework to measure and improve their performance and sustainability ambitions effectively and consistently,” Tessy Martens explains. She is the Sustainability Services Lead and together with Pierre Poncelet is building the Sustainability Centre of Excellence team at BDO Belgium. “It also provides investors, banks, regulators, clients, suppliers and other stakeholders with additional information that they can use to inform their decisions. Finally, it also reduces the risk of greenwashing.”

Roularta Media Group – “CO2 neutrality in 2040”

Roularta Media Group directs the sustainability strategy on four priority SDGs and thus aims to create added value for all its stakeholders and society. “As a media group, we are strongly committed to ‘brainprint’: we stimulate awareness and more sustainable behaviour with reliable, independent content. Investing in sustainable economic growth, in our people and their well-being is an important focus. We are committed to continuously improving energy consumption in both the office and production environments. In our procurement and collaboration with suppliers, we expressly opt for efficient use of materials and waste reduction. That’s why we aim to achieve a significantly smaller ecological footprint, in particular CO2 neutrality by 2040.” – Ingeborg Locy, Sustainability Officer Roularta Media Group

Who should report and when?

The timeline for implementation of the regulation comprises three stages. The scale and size of your company determine at which stage your company must comply with the directive. The diagram below specifies who is in scope and when.

Some subsidiaries are exempted if their non-financial information is included in their parent company’s sustainability report and this complies with EU standards or equivalent standards.

For non-EU companies, sustainability reporting will be required for companies that generate an annual net turnover of EUR 150 million in the EU and that have at least one subsidiary or branch in the EU.

Unlisted SMEs may apply adapted and proportionate standards voluntarily. SMEs can also opt out during a transitional period, meaning they are effectively exempted from applying the directive until 2028.

BDO Belgium – “Setting a good example”

BDO welcomes the introduction of a European single directive and wants to set a good example by complying with the directive sooner than required. “We firmly believe that we need to be transparent towards all stakeholders about the course we are taking, the actions we are taking and the progress we are making on our material themes. At the end of 2022, BDO Belgium will be publishing its third ESG report.” – Aubry De Pauw, Internal Sustainability Lead BDO Belgium

What to report?

Today, many companies already report on non-financial matters, based on a voluntary framework or standard. Leen Lefevere, Legal Sustainability Advisor at BDO Belgium: “They rely on the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) or the International Business Council (WEF IBC) of the World Economic Forum or one of the other 400+ standards/frameworks for this. The CSRD introduces a new, uniform European standard, the European Sustainability Reporting Standards (ESRSs).”

Without pre-empting too much, the information you will be required to disclose will be ESG-related. These topics will be refined in line with the industries and company-specific topics can also be added. “For relevant (material) ESG topics companies will be required to report on their strategy and ambition, how they are implemented, as well as the relevant performance indicators. Qualitative and quantitative, retrospective, as well as forward-looking data, will be requested.”

Where to start?

Nearly 90% of the respondents in the poll that we held during our first CSRD webinar in June indicated that they will (further) tackle challenges in terms of the sustainability transition and reporting both internally and with other stakeholders in a next step. “Awareness is already growing,” Tessy says.

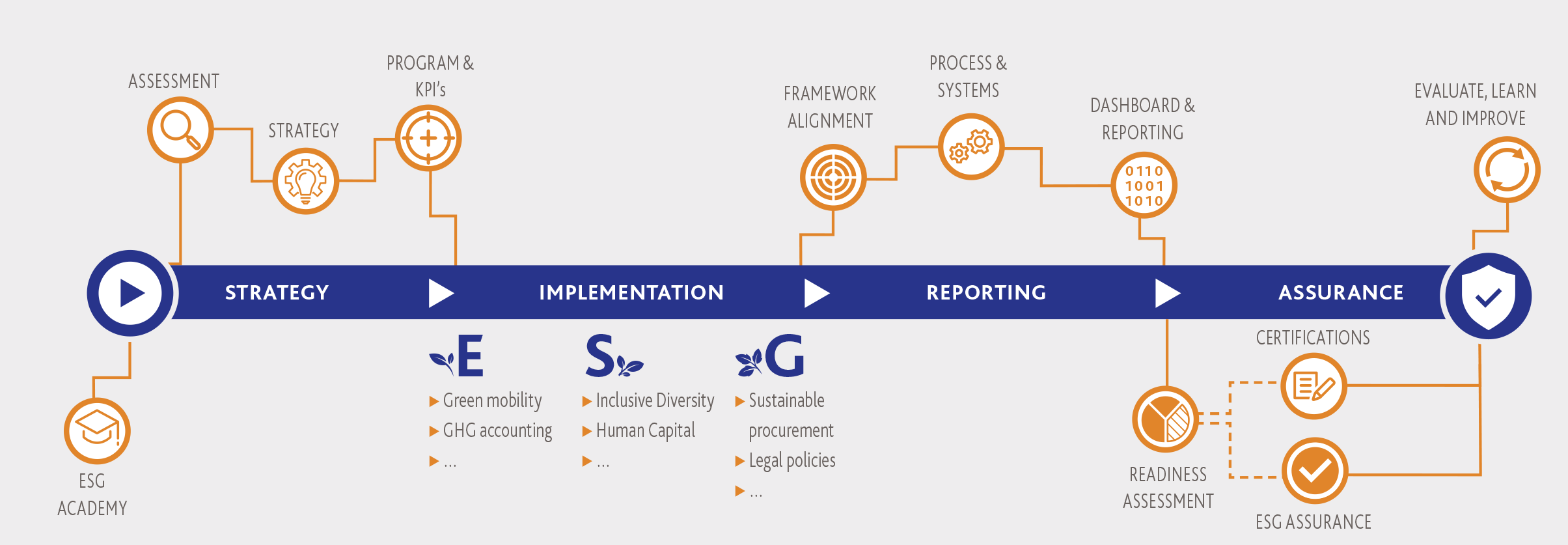

But reporting is not the first step in the sustainability journey for companies. (Also read the article “Learning from each other, for each other, worldwide!”). They need to start by defining the main focus and strategy, together with the most important stakeholders. In addition, reporting on sustainability information poses new challenges for many companies because their information systems are often ill-equipped to collect and process this type of information. “My piece of advice? Don’t wait! And do not underestimate the preparatory phase. You should also consider the impact that the CSRD potentially has on your business model, strategy, risk management, cost structure, etc.”

Bear in mind that companies that do not yet have to report may also be pressured into doing this sooner by their stakeholders. “We call this the trickle-down effect (also read the article “Good governance is no longer an option”). Being proactive and integrating sustainability into your business model increases your resilience against drivers of change, creates new business opportunities, leads to better results, and ultimately increases the value of your business. Incorporating sustainability into your business model is both the right and the smart thing to do.”

3d investors – “Tomorrow’s Winners”

As a family investor, 3d investors has been committed to sustainable business for more than 20 years. “We firmly believe that sustainable value creation starts with caring for employees, customers and the social context in which we do business. Great adaptability to the changing social and regulatory context is essential in this regard. Companies that operate within that vision will also be tomorrow’s winners. There is nothing as stable as change. We want to support our portfolio of companies as much as possible to further professionalise their ESG approach and strengthen our investment policy.” – Hans Swinnen, Partner 3d investors