Tax Assurance and Risk Management

Towards a culture with no surprises

Werner Lapage, Partner BDO Tax

We all like surprises! Except from the tax authorities. Every organisation has to pay taxes, but no company wants an unexpected tax bill in its letterbox. Moreover, tax errors and alleged unethical conduct keep everyone wary of taxes. Yet, despite the potential negative consequences, companies are often unaware that they are not complying with their tax obligations. The cause is double: organisations can no longer see the forest for the trees and they lose track of their tax obligations; or, they think that a detailed ‘Tax Control Framework’ is primarily a matter for large multinationals. Wrong twice!

“A company that attaches importance to good governance also pays attention to its tax assurance and risk management policy.”

Tax risk management, and ensuring control of your tax position, are increasingly evolving from ‘nice to have’ to ‘must have’ within a company’s or organisation’s risk management. Achieving a culture without tax surprises is good for any business – regardless of size, industry or tax risk profile.

According to Olivier Michiels, Partner BDO Tax, tax assurance and risk management go much further than simply managing tax risks. And this is anything but a matter that only concerns the tax or finance department (of multinationals). “It is a mindset, a culture within the organisation, that starts by formulating a tax strategy in line with the broader corporate mission, vision and strategy. And this is implemented in policies, processes and technological solutions that ensure compliance and make it possible to identify, manage and report tax risks in good time. This applies to all types of taxes and at all levels of the organisation. A company that attaches importance to good governance should also pay attention to tax assurance and risk management.”

Due to the increasingly complex tax systems, increased tax reporting obligations, and closer national and international cooperation between tax authorities, the need for a substantiated tax assurance and risk management policy is growing. “But don’t just regard that as a burden,” stresses Olivier Michiels. “There are also benefits. But of course you have to redeem them. Due to the complexity, companies are missing out on tax benefits or opportunities more than ever. A company’s clear and transparent tax strategy – and communication about it – also contributes to the realisation of the company’s ESG (Environment, Social and Governance) policy and sustainability objectives.”

Tax assurance and risk management

Tax risk is the risk that a company might pay or book too much or too little tax. Or that the tax positions are in conflict with tax legislation or with the director’s tax risk appetite.

Tax risk management is the way in which the organisation identifies, manages and reports on the amalgam of tax risks. It consists of policies, processes, tools and technological solutions that roll out the tax strategy in concrete terms.

Of course, policies, processes and tools are useful only when they’re implemented appropriately, adequately, effectively and correctly. Through periodic internal or external control and assessment mechanisms, tax assurance ensures that this is the case.

Benefits of a tax assurance and risk management policy

All too often, Olivier Michiels hears that “the development, implementation and maintenance of a tax assurance and risk management policy is a complex, expensive matter that requires a great deal of effort. And, furthermore, it only benefits multinationals.” So wrong! “An effective tax risk management does not need to be complex at all. Moreover, the principles of such a model can be tailored to any company.”

Culture with no surprises

The main purpose and benefit of a tax assurance and risk management policy is to promote a culture in which there are no surprises for anyone.

As Benjamin Franklin rightly said in his letter to Jean-Baptiste Le Roy in 1789: “In this world nothing can be said to be certain, except death and taxes.” Every organisation faces taxes – and no company wants to pay unexpected costs in order to rectify a tax issue. In addition, tax errors and alleged unethical conduct can have a major impact on trust and relationships with all stakeholders.

An effective tax assurance and risk management policy provides clarity for all parties involved, both internally and externally. Thus, shareholders can be confident that their investment value will not be affected by an unexpected tax bill … and that their name will not appear in the news linked to a tax scandal (for example).

Essential instrument for ESG and sustainability policy

Sustainability goes far beyond environmentally-friendly business. It’s a comprehensive story of values and norms – and, as Peter Van Laer wrote in his opinion piece in the previous To The Point, it offers “the format for a prosperous and resilient economy with long-term perspectives.” Values and norms in which a company’s tax policy and behaviour also require attention. This is no surprise when you remember that the United Nations already recognised in 2015 that taxes play a crucial role in achieving the Sustainable Development Goals (the so-called SDGs) (read the box titled ‘Taxation and sustainability’). Olivier Michiels: “In other words, taxes are a key ESG metric: external stakeholders are interested in a company’s tax behaviour, in the fact that it demonstrates its tax responsibility in terms of aggressive tax strategies, and in the extent to which it creates economic value for society.”

Taxation and sustainability

Taxes are important sources of income for government and are essential to a country’s budgetary policies and macroeconomic stability. Taxes enable governments to invest in public services, such as healthcare, transportation and education. Tax revenues also fund the transition to green energy and the promotion of diversity, inclusion and gender equality. Tax policies also impact other areas of sustainable development, such as: investments in infrastructure (domestic and foreign tax incentives), environmental sustainability (carbon taxes), and the health of the general population (taxes on harmful and unhealthy products).

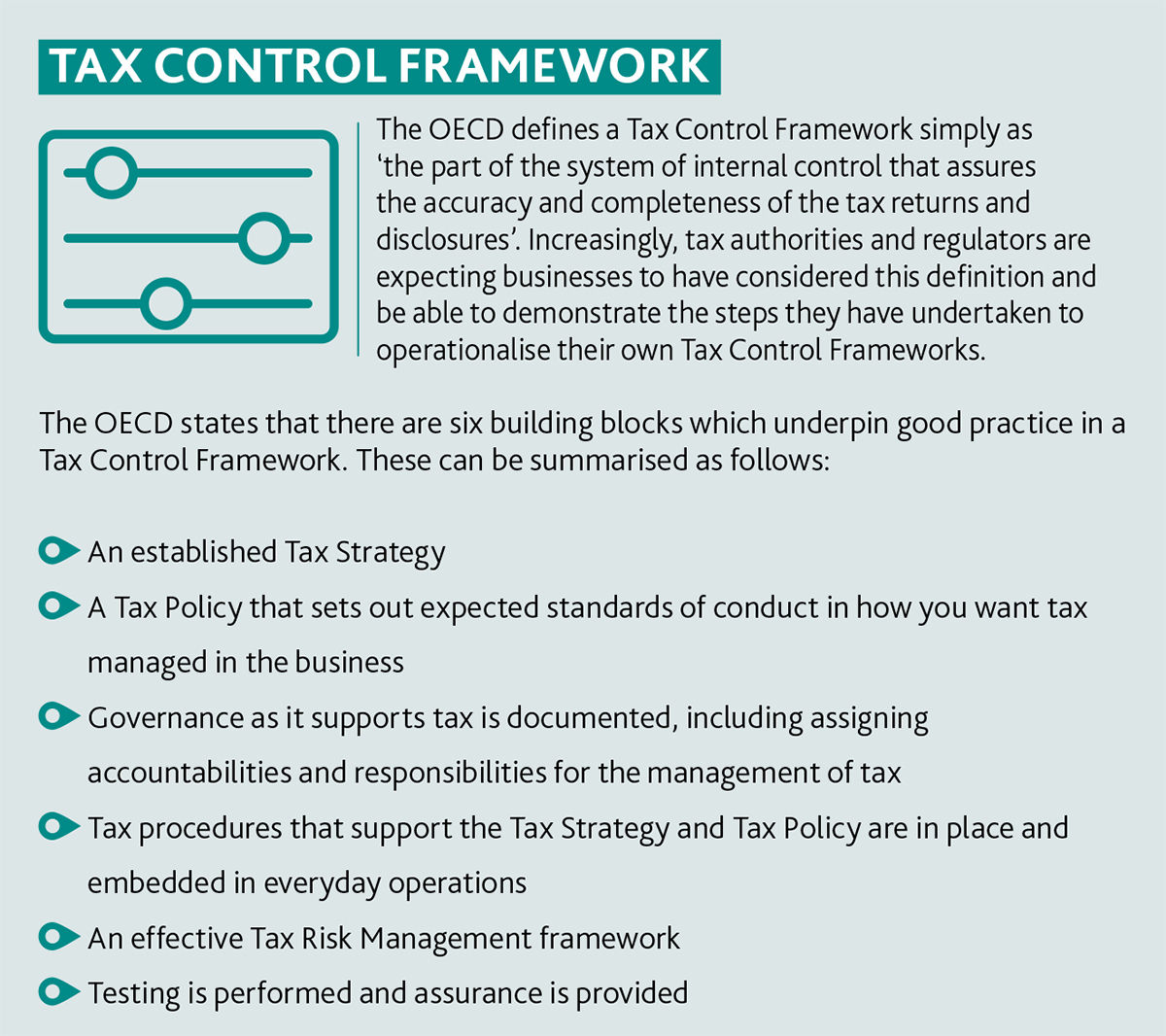

The Tax Control Framework: cornerstone of your tax assurance and risk management policy

The core of your tax assurance and risk management policy is a robust Tax Control Framework (TCF). The TCF helps organisations ensure the accuracy of their tax returns and disclosures. Thanks to the TCF, your company will gain a better understanding of the vulnerabilities of its tax policy, so that you can optimise procedures and processes. “Moreover, a TCF helps you address issues resulting from an unexpected audit result, high staff turnover in the finance department, rapid growth, and so on,” says Olivier Michiels.

A developed tax assurance and risk management policy is intended to enable a culture in which one is no longer faced with surprises.

Where do you start?

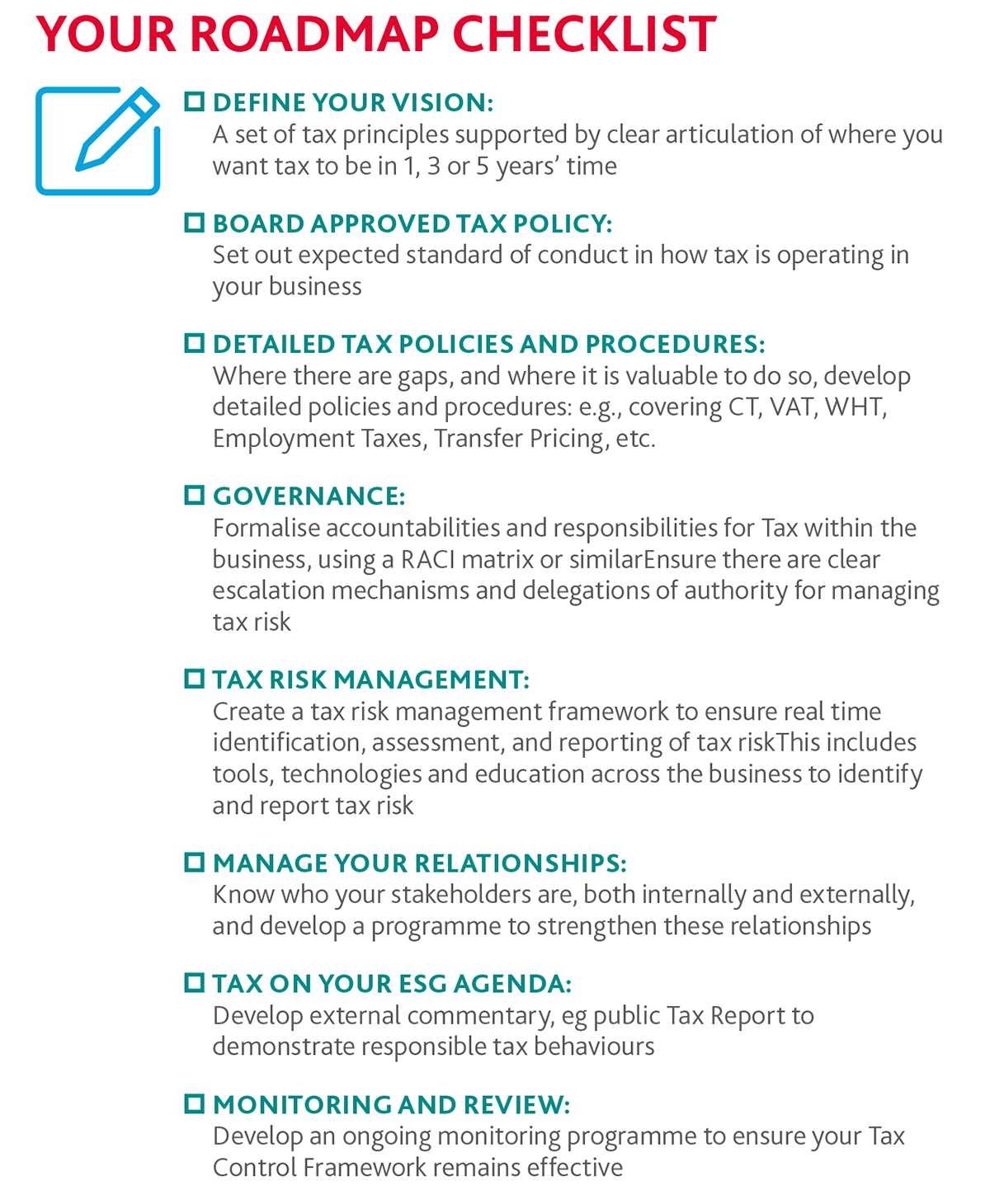

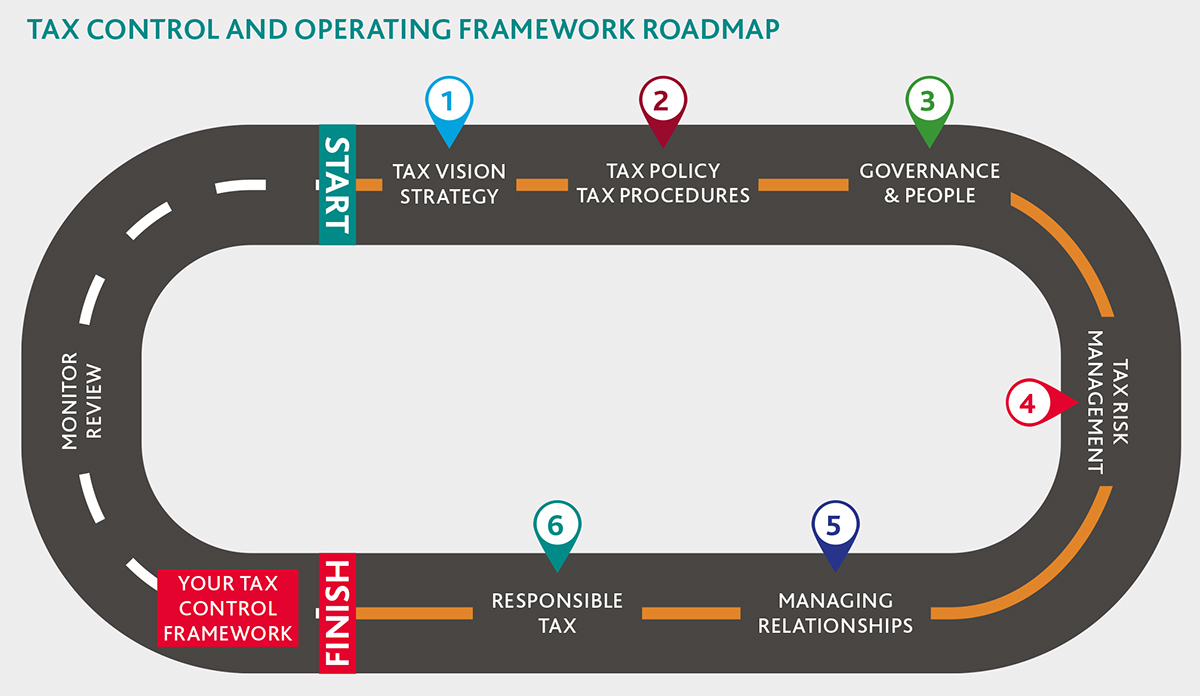

BDO has developed a ‘Tax Control and Operating Framework Roadmap’ to help our customers draw up a TCF. The roadmap or hands-on guide provides a framework and tools for effective tax management within your company or organisation.

Tax Control and Operating Framework Roadmap

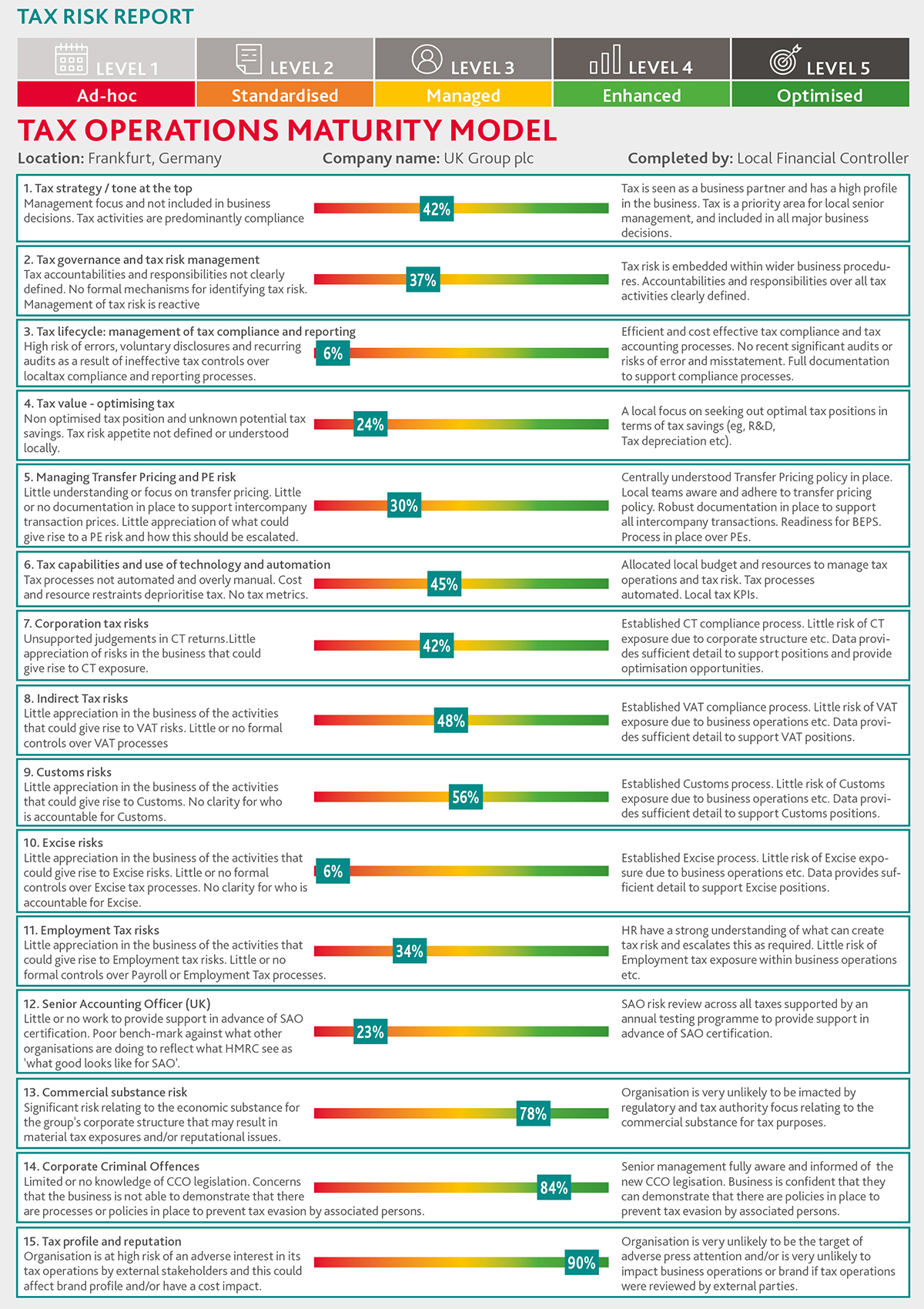

We usually start by benchmarking how taxes are currently managed within the company (via our ‘Tax Operations Maturity Model’ assessment). This soon shows what works well and which points deserve attention. Our ‘Tax Risk Report’ presents an overview, per business unit or area of activity, using traffic lights (Red, Orange, Green). You can see at a glance where the shortcomings are located. And what our recommendations are.

Tax Risk Report

In this way, you discover the strengths and weaknesses in your tax assurance and risk management policy. And you obtain the key ingredients and building blocks for building a resilient and effective Tax Control Framework (or refining your existing framework).

How watertight is your tax policy? Do the check!